Devaluing the Dollar

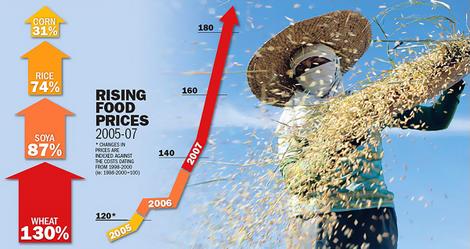

The way a country devalues their currency is by printing money to get out of debt. The verbiage you’ll hear is “bailout”,”stimulus”, or “Quantitative easing”. Any of those sound familiar? The U.S. government has printed more money in the last three years than the previous 70 years combined. The U.S. Dollar has lost 10% of its value over the last year and will continue to drop. In other words, if you had $1000 in the bank a year ago, it can only buy $900 dollars worth of goods today. Printing more money causes inflation, which causes everything you buy to be more expensive. More and more people will be unable to pay for the basics of life, including food, becuase their money can’t keep up with inflation. As your cash becomes worth less, everything you buy costs more.

The scariest part of the U.S. government printing money is that any time a country has devalued their currency, that currency has always gone to zero. Having a food storage supply of seeds protects you even in the worst of conditions.